Bitcoin tanked going into 2019, but reedeemed itself handsomely. Can it do it again?.

Just recently, it fell from a high of $10,600 to a current price of $5,300.

Back in 2019, some pointed to a poor reception to the first Bitcoin futures contracts offered by the ICE Bakkt platform. In fact, the highly anticipated launch of those futures was quite disappointing with only $5.8 million BTC trading volume in the first week out.

Granted, many saw Bakkt as a catalyst to get institutions on board.

But it didn’t generate much interest at all.

More recently, Bitcoin has plummeted on Covid-19 global pandemic fears. Once considered a possible safe haven, Bitcoin took a beating.

But it’s not just Bitcoin. Other safe haven investments including Gold have also taken a beating.

Coronoavirus fears look like its driving investors to the sidelines and they are staying in cash.

Learn How to Spot Unique and Predictable Patterns in Cryptos

BTC has become technically oversold, as investors panic.

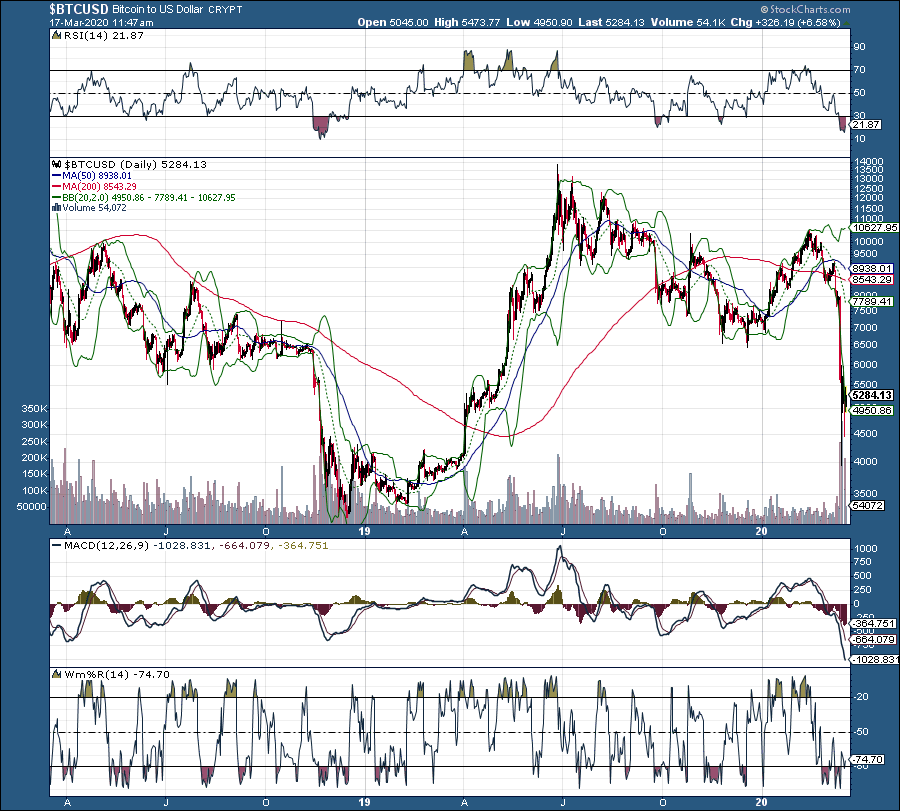

But as they panic, they’re creating opportunity deep in oversold territory. For example, here’s a one-year chart of BTC. Not only is BTC oversold at its lower Bollinger Band (2,20), it’s also excessively oversold on relative strength (RSI) and Williams’ %R.

Notice what happens each time RSI dips under its 50-line, a Full STO dips to its 20-line, and below. Shortly after, BTC begins to pivot and turn higher. These indicators alone are telling us BTC is wildly oversold at current prices, and overdue for a turn higher.

These same indicators are great at calling tops, as well.

For example, notice what happens when BTC hits its upper Bollinger Band (2,20) with RSI nearing its 100-line, and with the Williams’ %R above its -20 line. Not long after, we begin to see a pivot lower, as we’ve seen quite a few times.

With the latest move lower in BTC, keep an eye on it. Indicators say its very oversold.

Free Bonus Report: There are several patterns that can pinpoint the likely price movement of cryptos. Click Here to get the full report on how to spot these patterns.