Imagine trading a financial instrument that moves 10% per day. Almost every day.

If you want to come along for the ride, scroll forward, my friend. We’re in for a wild ride together.

And – before I get too far down the rabbit hole – shoot me a message anytime at rob@robcoin.com – I’d love to hear from you. Tell me about your journey into day trading the crypto market.

And now…

It all starts with a story.

PART ONE: Meet Christina

I met Christina at one of the trader shows. It was the Trader’s Expo in Las Vegas in October of 2017.

She was standing at the door to my presentation room, checking her phone. Because I’m naturally gifted at conversation (this is not true), I decided I’d ask if she was checking prices.

“Oh yes,” she said. “I day trade Bitcoin.”

Day trade? I thought.

Every person I’d ever met was just buying and holding coins.

“You day trade it?”

“Yep. Right from my phone.”

And sure enough, she did. She sat down for a few minutes and showed me what she was doing.

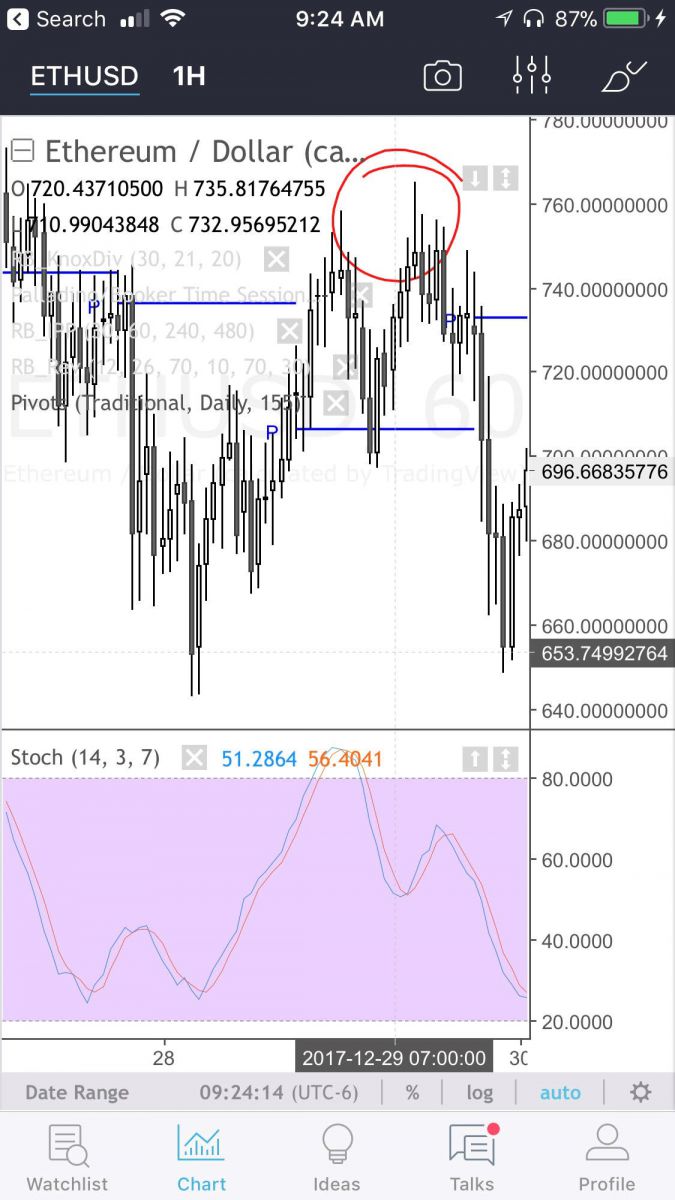

Here’s what her phone looked like:

Learn How to Spot Unique and Predictable Patterns in Cryptos

That’s a current shot from my phone – I didn’t ask her to give me a screen shot from hers (ok, I did, but she refused, haha).

She was charting and trading right from her phone, and here’s what she told me.

“I used to day trade stocks. I lost money. Then I did options for a while, and everyone seemed to be making money except for me. Everyone was talking about how easy it was. But I started to feel like they were either lying or I was stupid. And I don’t think I’m stupid.

“So one day I followed a link online and opened a cryptocurrency trading account. And I never looked back. I found something that was working for me, instead of me working for it.”

In other words, she stopped struggling.

And she started winning.

I’d been trading for 17 years and I knew exactly what she was talking about – sometimes if we just change what we’re trading, we do better. Sometimes it’s all about finding something that’s a better fit.

That day, I dropped everything I was doing, and I started mapping out how my current strategies – the ones I’d built over 17 years – would work on the crypo market.

And I was shocked. Everything I was doing in forex and stocks worked better, and more easily on cryptocurrencies and altcoins.

And then it struck me: I knew exactly how I wanted to trade this market.

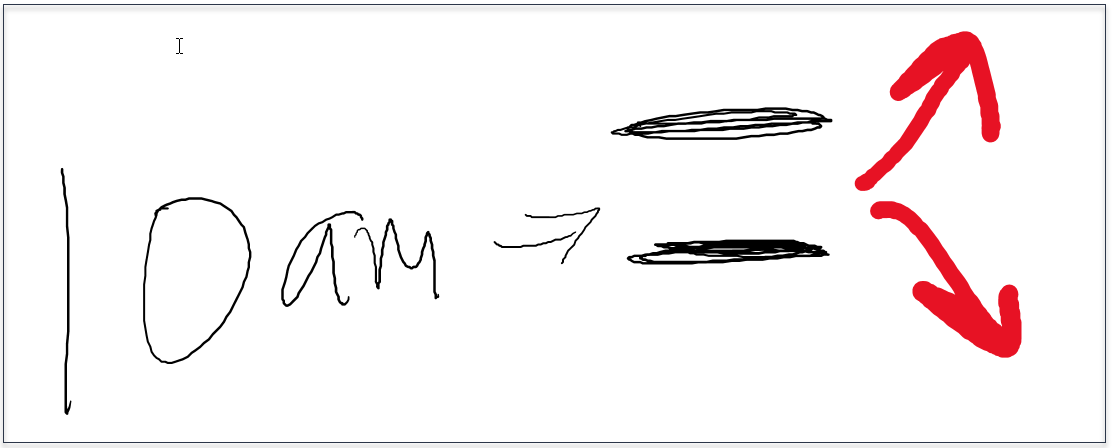

I went back to the hotel bar, grabbed a drink, and scribbled this diagram on a napkin:

That silly, simple diagram led to the single highest-probability trading method I’ve ever used.

And I’d like to share it with you.

But first, a WARNING:

- If you like complicated stuff, this isn’t for you.

- If you like fancy indicators, this isn’t for you.

You see, I don’t like complicated stuff. In 17 years of trading, I’ve made most of my money doing things the simple way.

So, if you like simple, this is perfect for you.

If you like doing things the easy way, this is perfect for you.

If you have 12 minutes a day – which is a perfect amount of time – this is perfect for you.

And no one is even looking at this right now.

So – with that said – if you’re ready … let’s get into it.

PART TWO: Why Day Trade Bitcoin and Altcoins Instead of Stocks, FX, or Options?

There are three reasons you should consider day trading cryptocurrencies:

- They move A LOT. Every day.

- They trend. Better than anything else I’ve seen in 18 years.

- They’re “technically obedient” – meaning, your favorite indicators will work as well or better on cryptocurrencies than anything else you’ve been trading.

If you’re winning already at forex, or options, or stocks – this is a great addition to what you’re doing. And if you’re not winning already – this just might be exactly what you’ve needed.

A common misconception about cryptocurrencies:

People think that buying and holding Bitcoin, or Ether, or one of the other coins, is the best way to get involved. That’s crazyballs. That’s insane. And not even close to being true.

Here’s why you don’t want to just buy and hold Bitcoin (or any other cryptocurrency):

- One day Bitcoin (and all the coins) is gonna crash. And it’s gonna be nasty. Why would anyone want to be holding onto a ton of Bitcoins on the day it crashes? When you day trade – you’re settling up your trades every day. No need to worry about what happens overnight.

- You reduce your time in the market. No more endless screen time!

- You stay in the market for a big trend, and then you get out. No more holding during the time it just moves sideways.

The big, established coins give us the chance to:

- Make money on predictable, repeatable patterns – daily.

- Cash out at the end of every trading day – so you’re not holding positions overnight.

- Have the potential to make gains of 5-10% every day.

If that sounds good to you, then you’re in the right place.

The biggest opportunity in 2018 is in day trading bitcoin, Ether, Litecoin – the majors. They move. A lot. They trend. All the time. And your favorite indicators work brilliantly on them.

Let’s make some money.

I’d like to share my favorite strategy with you.

For trading, I trade on Poloniex and Bittrex, and I’m opening up new accounts all the time to test out the exchanges (and do some arbitrage, as I’ll explain later).

A COMMON QUESTION: WHY WOULD I SHARE MY FAVORITE STRATEGY?

If something is working, why not just make money from trading it? Why share it?

That’s a totally reasonable question.

And I’ve got two answers.

First: When I share what I’m doing with a big group of people, and we stay in touch with each other about it, I do better. We refine the strategy together, we improve it, we test it. I’ve been sharing strategies with traders for 17 years – and most of the time for free – because it helps me make more money.

Well, actually, I only have that one answer. Ha. I enjoy sharing – and it helps me improve the strategies that we trade together.

PART THREE: The Bitcoin Box

To trade this method, you simply need the following:

- A 5-minute chart for Bitcoin.

- The Stochastic Oscillator, set to 30,10,10.

- A watch. (haha)

Here’s the step-by-step method:

- At 10 A.M. EDT (New York) each weekday, you’ll check to see if the Stochastic is overbought or oversold.

- If it’s neither – that’s great, you can proceed to the next step.

- Draw a box around recent price leading up to 10am. Start around 6am, and pick a high and a low – then draw a box around that price. That gives you about 4 hours of price action to use for your box.

Here’s what it will look like:

Let’s walk through each item step by step:

- Step 1 – we check to see if it’s 10 A.M. EDT It is, so we can move ahead.

- Step 2 – is the Stochastic overbought (above 70) or oversold (below 30)? No, it’s not. So we can move forward.

- Step 3 – we draw a box around recent price action. I know that the box I drew looks terrible. Haha. I just free-handed it. I was not born to be an architect.

Now, once we have our box drawn, we can wait for price to break out.

The chart above explains it all.

When price breaks out above the box, we buy.

If price then retreats back down to the top of the box – that top of the box becomes support. And we can buy it again at that level.

Our stop-loss easily goes right inside the box – either right below the top of the box for a tight stop, or halfway the distance into the box for a slightly larger stop. I don’t recommend placing large stops (for example, below the bottom of the box). Large stops are a great way to lose large amounts of money.

For a target, we have a few options:

- We can wait until the Stochastic goes overbought, and then start to exit the trade.

- We can set a profit target equal to the size of the original box. So if the box is $50 from top to bottom – then our profit target can be $50. You might want to set a target at $45 to account for spread and volatility.

Those are my two favorite ways to set targets.

Now, all of this is reversed if price breaks out the bottom of the box. In fact, when price breaks out lower, I like to set bigger targets because Bitcoin falls faster than it rises. So when you get a winning trade on the sell side – it can pay to ride that a little bit longer.

This entire process takes about 12 minutes each day.

I go to the charts at 10am, set the box, set my orders, set my stop and target – and then walk away. I do better when I don’t touch it or monitor it.

PART FOUR: The Bitcoin Box on Steroids

Now – we can take this little strategy even farther if we do a two simple things:

- We can buy the Bitcoin (or sell it) on one exchange, and then close the trade on a different exchange – for a huge increase in profits.

- We can limit our trading to certain days of the week when these breakouts are especially volatile (and have a lot more potential to move 5-10% in just a few minutes).

If you’d like to take this a step farther – visit me at RobCoin.com and I’d be happy to help out.

And stay in touch anytime – just drop me a line at rob@robcoin.com, day or night.

Free Bonus Report: There are several patterns that can pinpoint the likely price movement of cryptos. Click Here to get the full report on how to spot these patterns.